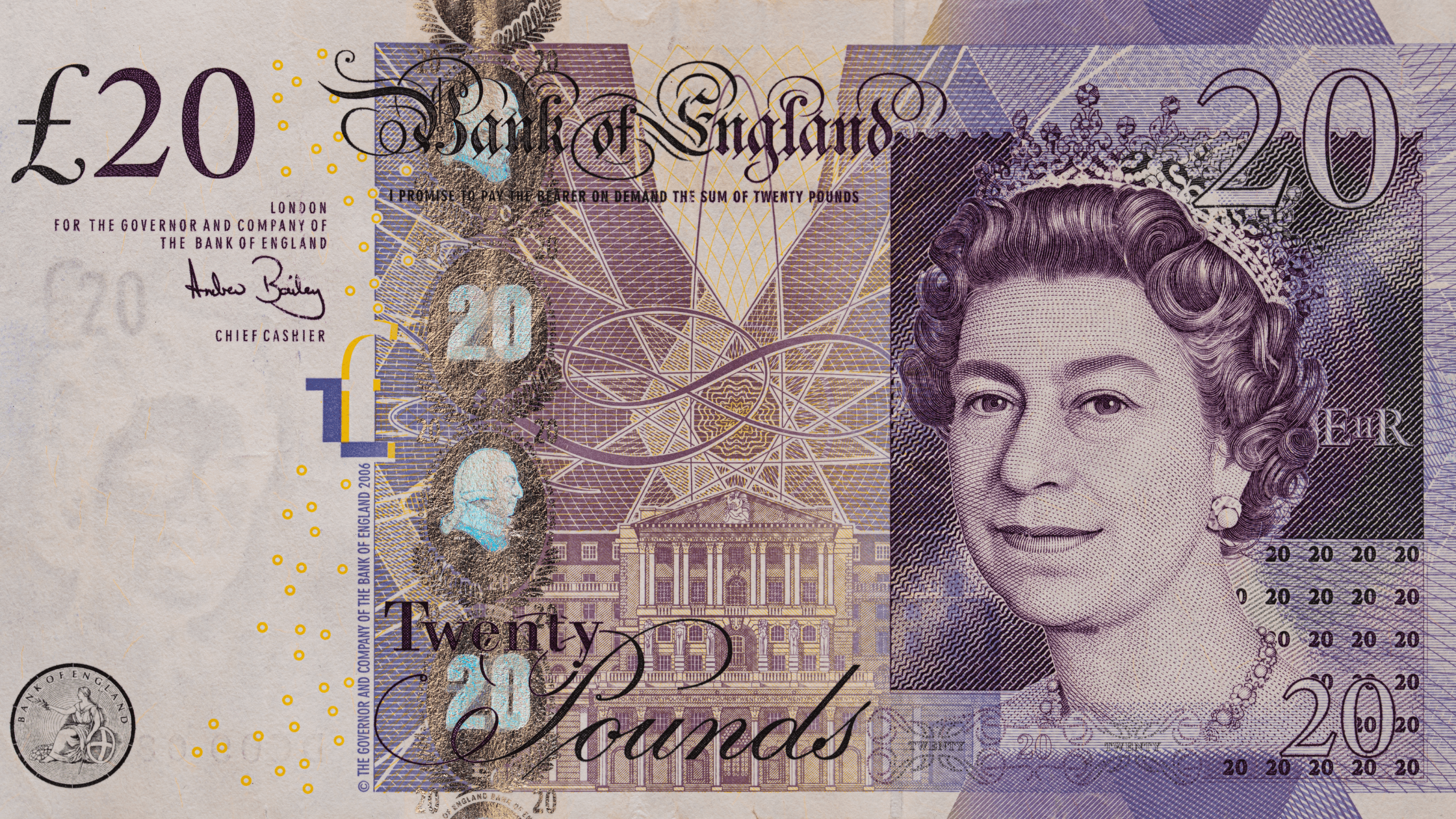

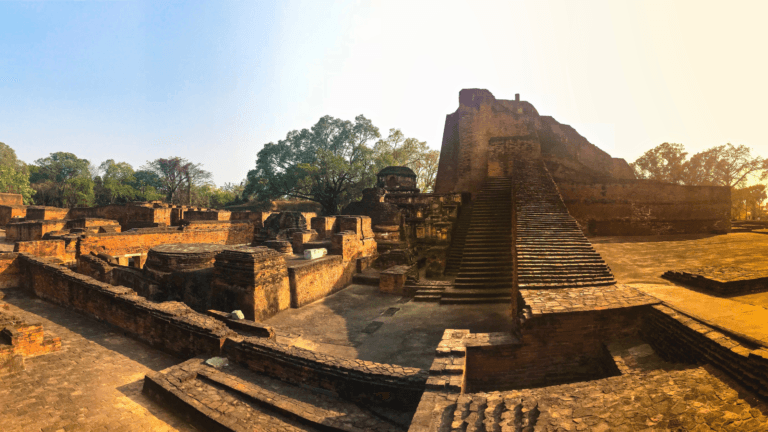

Mumbai, the financial capital of India, is a bustling hub for international travelers and expatriates. Whether you’re a tourist or a business traveler, converting GBP (British Pounds) to INR (Indian Rupees) is a straightforward process in this vibrant city. This guide will walk you through the best ways to exchange currency efficiently and securely in Mumbai.

1. Understanding Currency Exchange in Mumbai

Mumbai offers numerous options for currency exchange, including:

- Authorized Money Changers

- Banks

- Forex Services at Airports

- Online Forex Platforms

It’s crucial to choose a reliable service to avoid exorbitant exchange rates or hidden fees.

2. Best Places to Exchange GBP to INR in Mumbai

a) Authorized Money Changers

Mumbai is home to several RBI-approved money changers like Thomas Cook, Weizmann Forex, and UAE Exchange.

- These outlets are widely available across the city.

- They offer competitive rates and a hassle-free experience.

b) Banks

Indian banks like HDFC Bank, ICICI Bank, and State Bank of India (SBI) provide currency exchange services.

- Pros: Reliable and secure.

- Cons: Require more documentation and may have slightly lower rates compared to money changers.

c) Airport Forex Counters

If you’re in a rush, you can exchange your GBP to INR at the Mumbai International Airport.

- Pros: Convenient, especially for last-minute transactions.

- Cons: Typically higher exchange rates compared to city outlets.

d) Online Forex Platforms

Platforms like BookMyForex and ExTravelMoney allow you to lock in rates online and collect cash from designated outlets.

- Pros: Competitive rates and transparency.

- Cons: Requires planning and internet access.

3. Documents Required for Currency Exchange

To exchange GBP to INR, you’ll need to provide:

- Valid Passport (especially for tourists).

- Visa (if applicable).

- PAN Card (for Indian residents).

- Travel Tickets (sometimes required).

Ensure all documents are photocopied and signed for ease of processing.

4. Tips for Getting the Best Exchange Rate

Compare Rates

Always compare rates from multiple sources to ensure you’re getting the best deal.

Avoid Airport Counters for Large Amounts

Airport counters are convenient but usually offer less favorable rates. Use them only for small amounts.

Use Online Tools

Apps like XE or Google Currency Converter can help you monitor real-time exchange rates.

Exchange in Bulk

Larger amounts may fetch better rates due to reduced transaction costs.

5. Safety Tips When Exchanging Currency

- Use Authorized Dealers

Ensure the dealer is RBI-approved to avoid counterfeit notes or fraud. - Check the Receipt

Always take a receipt for your transaction. It’s mandatory for authorized dealers to provide one. - Count Notes Carefully

Before leaving the counter, verify the amount and count your notes. - Avoid Street Vendors

Unlicensed vendors may offer attractive rates but can be risky.

Conclusion

Exchanging GBP to INR in Mumbai is a straightforward process if you choose the right service provider. With options ranging from banks to authorized money changers and online platforms, you can enjoy a hassle-free experience. Remember to compare rates, keep essential documents ready, and prioritize safety during your transactions. By following this guide, you can ensure that you get the best value for your money while exploring the vibrant city of Mumbai.